People sometimes make unpredictable choices, Dominic van Kleef knows

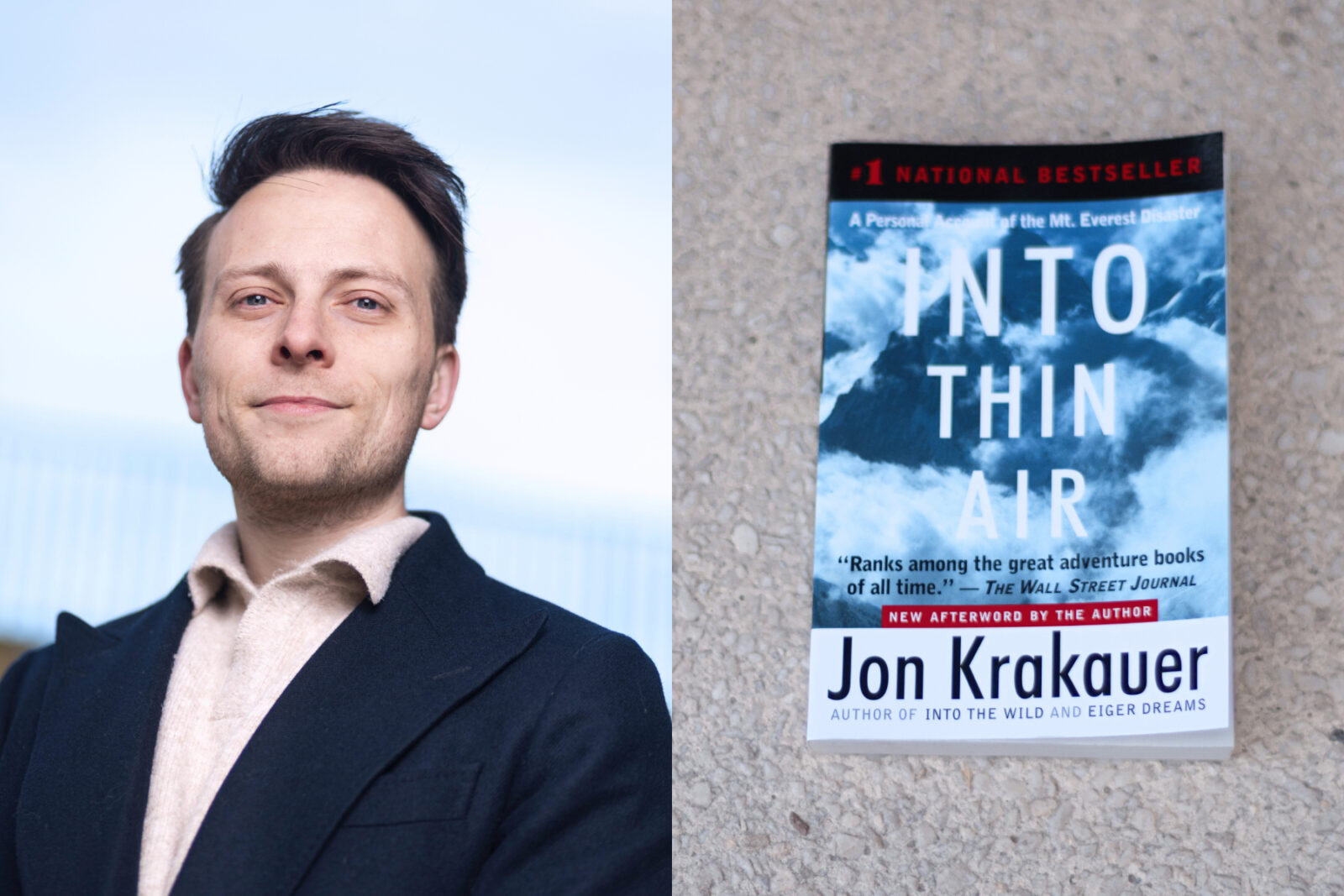

Investors are unpredictable; alpinists just as much. Dominic van Kleef researched investment behaviour, and in his spare time he occasionally picks up the book Into Thin Air to immerse himself in a story about people who want to reach the summit of Mount Everest so badly that they lose sight of reality.

Image by: Leroy Verbeet

People are unpredictable when they… Fill in the blank. Dominic van Kleef researched investment behaviour. Investors can sometimes lose their rationality, Van Kleef knows, but the same applies to people filling their trolley in the supermarket or the alpinists who wanted to reach the summit of Mount Everest against the laws of nature. The American journalist and writer Jon Krakauer wrote the book Into Thin Air about one of the deadliest expeditions ever, the Mount Everest Disaster of 1996. Eight climbers lost their lives.

Van Kleef rereads the book from time to time. “Those people had prepared well and then, at the last moment, they were so obsessed with the summit that they kept going against their better judgement. Human behaviour is ultimately unpredictable.”

Dominic van Kleef obtained his PhD at the Law & Business department. He now works as a legal professional at the Netherlands Authority for the Financial Markets and remains affiliated with the Erasmus University as a guest lecturer and thesis supervisor.

Research is not advice

Van Kleef himself would not dream of climbing Mount Everest. He is happy to go into the mountains, but you do not need to call him for such a thrilling expedition. “I don’t take many risks”, he says.

He gives the same answer to people who, because of his research, ask him for investment advice. “Choose the long term”, is as far as he will go. He himself invests safely, risk-averse and without many interventions in his portfolio. Very different from the investment apps he sometimes looked at for his research. There are apps on the market where providers put the riskiest investments at the top of the page, tempting users to get involved.

Do not think in black and white

As a PhD candidate, Van Kleef spent more than four years on the question of how investor protection can align with how investors behave. When he started his PhD after his master’s in Financial Law, he still thought he would unravel the sometimes murky world of investors, but at the time he viewed investment regulation too much in black-and-white terms. “I thought the rules were still as if people are rational, but there is in fact consideration for the limits of human capacity. For example, policymakers think about the amount of information that should be provided with an investment. The idea is that people cannot process an overdose of information.”

And so Van Kleef began to look at the rules in an increasingly nuanced way and moved further and further away from a clear-cut answer. If he has to say something about his conclusion after four years of research, it comes down to this for the lawyer: “The riskier an investment, the more logical it is to offer the buyer protection.”

Reading habits

Number of books per year: 20–25. “But last year a lot fewer because of the preparation for my defence, about ten, I think.”

Main motivation: “With a novel it is relaxation, with non-fiction curiosity.”

Last book read: Into Thin Air – Jon Krakauer

Favourite genre: Fiction, books on history. “It suddenly sounds pretentious, but I’m now reading Russian classics.”

Good preparation is half the work

Van Kleef had prepared meticulously for the day of his defence, at the end of last year. “Weeks in advance I started reading the articles by the committee members. I prepared for possible questions. Everything to prevent not knowing the answer to a question.”

He turned his lay talk into a kind of pitch. “I used the opportunity to explain to everyone I know, in simple language, what I had been working on over the past four years.” In the run-up to his defence he remained relaxed, he looks back. But the evening and morning before, he stopped talking altogether. “My nerves were dramatic.”

And then it also happened that he did not have an answer to a question posed by one of the committee members. “The committee member quoted something from my dissertation and asked me whether what I had written there was actually correct. While he was saying it, I thought: he’s right, I didn’t write that clearly enough.”

It concerned the following: Van Kleef had written that if someone invests independently, all information obligations are important, whereas with investment advice those information obligations are less central. What he meant was that those obligations are secondary, indirect. What could he answer during his defence? “I agreed with the committee. I could have written it better. In my dissertation I weighed every word carefully, but it’s still two hundred pages. Thanks to my preparation, I was well prepared. Now I can enjoy that it’s over. It was a beautiful day.”

Read more

-

Lives are full of change, and that’s why Yara Toenders is researching the brain

Gepubliceerd op:-

Page-turners

-

De redactie

Comments

Read more in Page-turners

-

Lives are full of change, and that’s why Yara Toenders is researching the brain

Gepubliceerd op:-

Page-turners

-

-

Sam van Leeuwen teaches Dutch to newcomers integrating into society

Gepubliceerd op:-

Page-turners

-

-

The digital reality can be deceptive, knows Ofra Klein

Gepubliceerd op:-

Page-turners

-

Leave a comment