Why abolishing mortgage interest relief is not enough to solve the housing crisis

Most Dutch people actually live comfortably for an affordable price, private-sector tenants and those seeking housing however are paying the price in the current housing crisis. According to economist Matthijs Korevaar, the current housing policies mainly benefits homeowners. Abolishing mortgage interest relief is not enough in his view – the imputed rental value (eigenwoningforfait) must be raised. “Especially people who own their homes outright benefit from the current situation.”

Image by: Bas van der Schot

Has the housing crisis become more acute in recent years?

“Yes. Waiting times for social housing have risen sharply because there are increasingly fewer affordable homes available. Until the 1990s housing associations built many homes with government subsidies, but after their privatisation that support stopped. The government expected social housing associations to use their assets to finance new construction, but tougher rules and lower permitted rents made that unprofitable. Associations built less and even sold homes. Investors filled that gap by building, buying up properties, or splitting existing buildings into multiple studios or student units. That partly compensated the supply of rental homes, but at a much higher price.

“Regulating social housing therefore has perverse effects. Rents may not rise, but the availability of rental homes falls. We have ended up in a kind of lottery socialism where, if you are lucky, you live in a good and cheap home, and otherwise you pay a fortune or miss out entirely.”

Matthijs Korevaar is an Associate Professor of Finance at the Erasmus School of Economics. He studies the long-term dynamics of housing markets and focuses on the effects of policy, taxation, and inequality on the housing market.

Who are the people who miss out, and how large is that group?

Most Dutch people live comfortably, in an affordable home. Homeowners benefit from tax advantages and low charges. Tenants in the social sector often have housing for a low price. But a small group of private-sector tenants pays sky-high prices. And there is a growing group who cannot find any home at all. Because supply is limited, more and more people accept poor housing situations simply because there are no other options. And even that supply is shrinking now that investors are selling.”

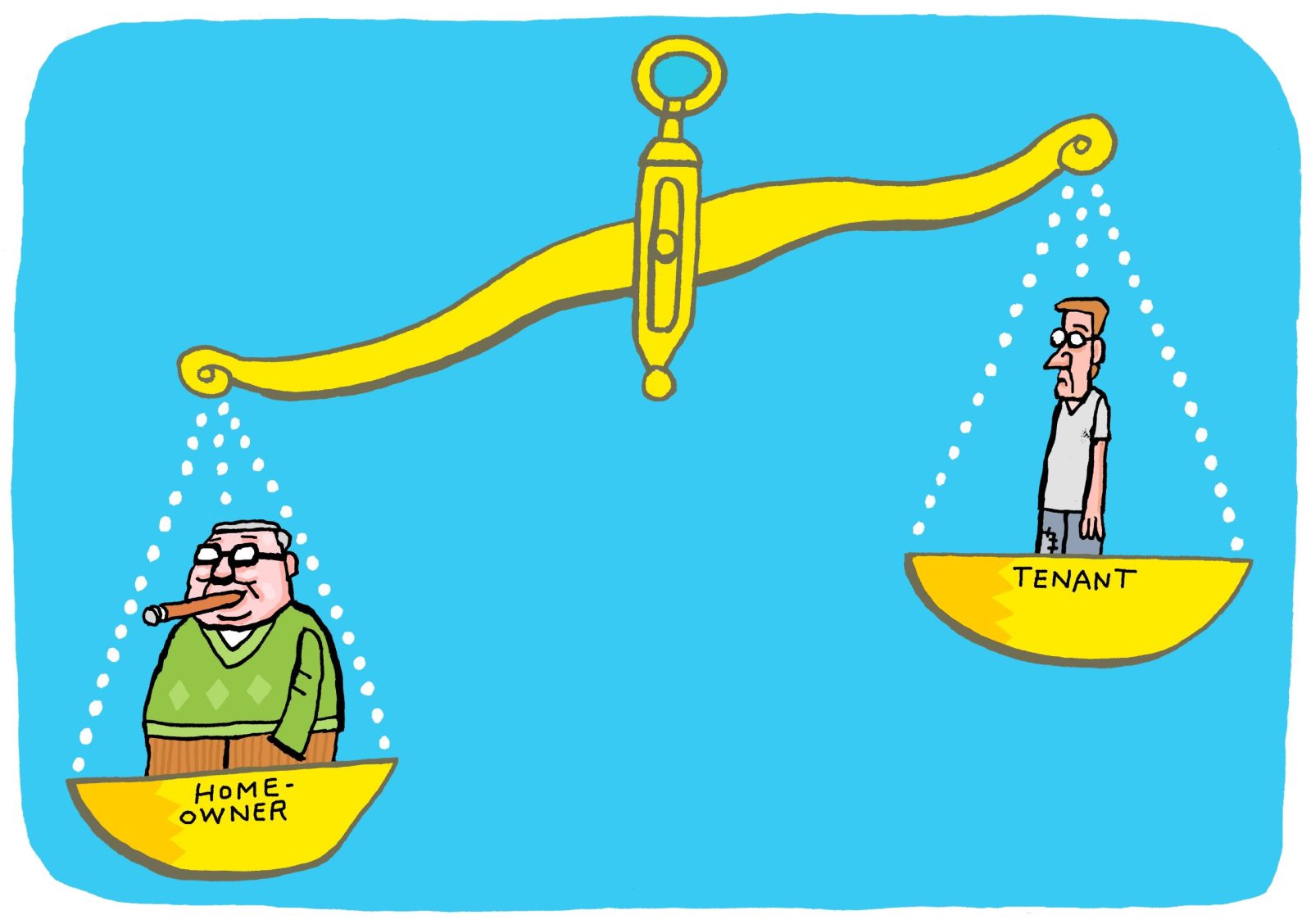

Image by: Bas van der Schot

Why are private landlords selling off their properties en masse now?

“Since 2023 taxes for landlords have been substantially increased and since last year rents have again been regulated. Measures have also been introduced that make buying more attractive than renting. First-time buyers pay no transfer tax, while investors paid 10 percent. And since last year many cities, including Rotterdam, have had purchase protection, which means you are not allowed to turn a bought house into a rental property. That plays well politically: those slumlords who make money at people’s expense should be taxed extra. Almost every party supports that. But in the end that is not a way to create more homes.

“Moreover, the reform of tax box 3 means that not a notional return but the actual return is now taxed. For property investors, who often achieve high yields, that means much higher tax. On top of that, wealth tax is now levied on a higher fiscal valuation of rented properties: no longer 70 percent, but closer to 90 percent of market value.”

Why did all these proposals nonetheless gain a political majority? Could politicians not have foreseen the counterproductive effects?

“All parties want to help first-time buyers, and the Netherlands supports them more than other countries. The ideology that owning a home is a good thing is extremely strong here, from left to right. In Germany, for example, buying a house is not the norm unless you are really wealthy.

“Once the majority owns a home, it becomes hard to argue for a law that raises taxation on owner-occupied homes. Parties also like to dress housing laws in a populist coat. Politics often pretends a measure is good for those suffering from the housing crisis. And apparently that is credible, even though it often turns out differently.”

‘And so a completely absurd measure was introduced’

Do you have an example of that?

“This year we had the crisis around the governmental spring budget memorandum (voorjaarsnota). That political debate produced a rent freeze out of the blue. It was an election promise from the PVV to lower rents. And that spring budget had to balance. What is an excellent way to save on the national budget? Lower rents, because for every euro you cut in rent the government gets back roughly 50 to 60 cents, since it pays less in rent allowance. So the PVV was happy with lower rents, the VVD was happy because the budget balanced.

“And so a completely absurd measure was introduced. For residents of social housing it was nice, but they already pay relatively low rents, especially given the rising quality standards for their homes. Housing associations, rightly, voiced their concerns because their costs are rising while they still have to meet all those requirements. Private-sector tenants did not benefit from the measure, and it did nothing for those seeking housing. Those who truly suffer from the housing crisis were therefore not helped.”

What can we expect from Prinsjesdag?

“I expect little. The transfer tax for investors has already been slightly reduced. I suspect they will keep that, but it is small beer. There may also be action on limiting interest deductions for housing associations, which is very tightly regulated by international tax rules. The rent regulation may be loosened somewhat. But major measures are unlikely. For students that means another year in a deteriorating housing situation.”

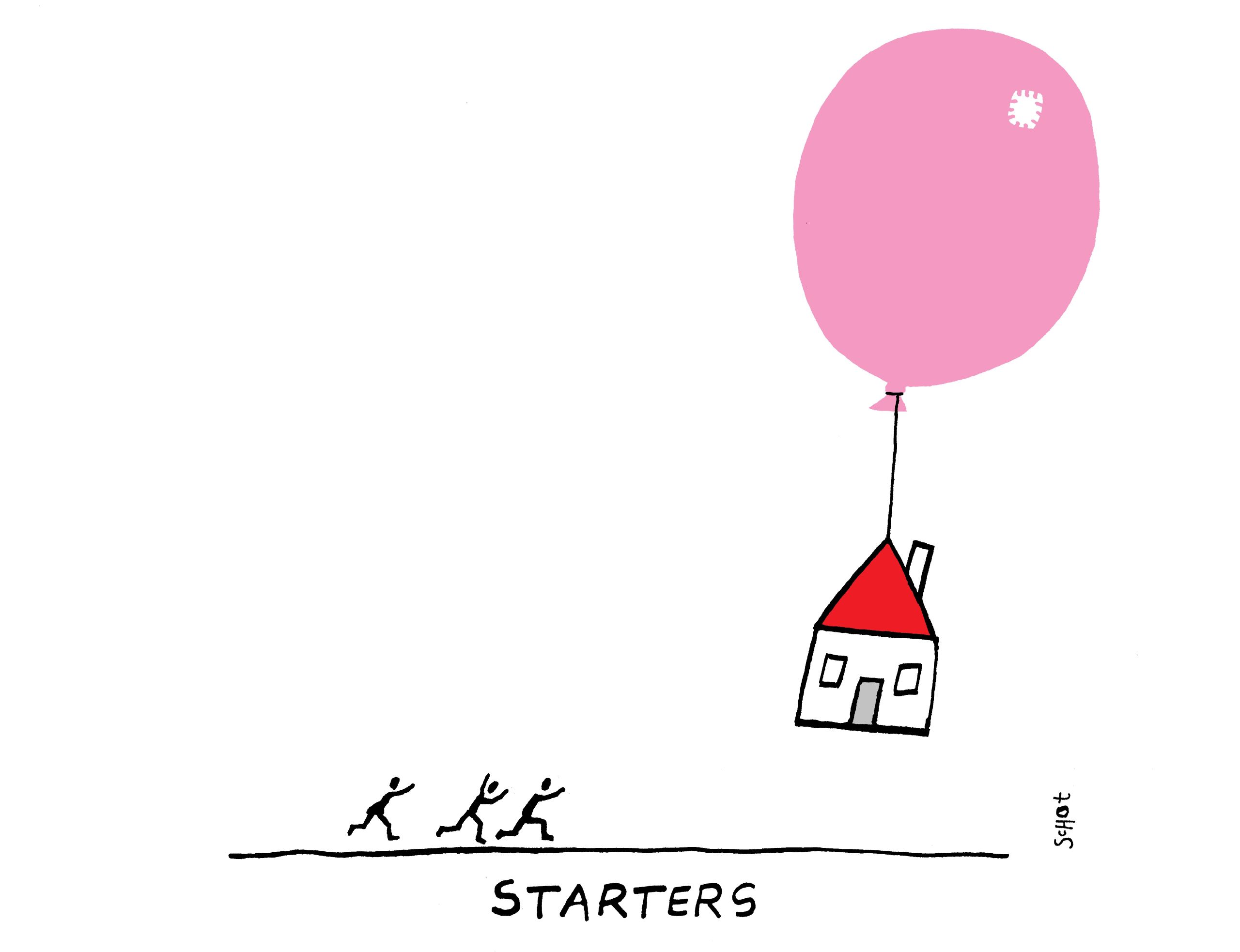

Image by: Bas van der Schot

So we should not expect much from Prinsjesdag. Is there more hope during or after the elections? Do parties have good plans?

“For voters this is a main issue. Almost everyone knows someone looking for a home, and many parents or grandparents worry about children or grandchildren who cannot find housing. The subject is also getting more attention through activist focus on the housing crisis. A political majority seems to be forming around phasing out mortgage interest relief, but it depends which parties end up in the next cabinet. VVD and BBB are strongly opposed, so in a coalition with them it is uncertain whether a majority will be achieved.”

Is abolishing mortgage interest relief a good idea?

“Not abolishing it entirely, but limiting it is. In the Netherlands people benefit substantially from mortgage interest relief, especially first-time buyers, because they can borrow the full value of the house. The deduction on that interest gives someone on an average income roughly an 8 percent-of-income tax advantage. That is a considerable subsidy.

“If you want rent and ownership to be equally attractive, abolishing the relief outright is not logical, because interest on other debts remains deductible. So a loan for a holiday or a rented home is deductible, but a loan for your own home would not be. That is odd. Better is to limit the deduction by, for example, reducing the maximum mortgage. That would mean people can borrow less, and therefore there is less interest to deduct.

“We must give up the idea that abolishing mortgage interest relief would be good for first-time buyers. Parties such as GroenLinks–PvdA and the CDA now claim that the large fiscal differences between buying and renting push up house prices. That is true to some extent. But the financial benefit of the deduction mainly goes to first-time buyers with average incomes and not to older homeowners with higher incomes. House-price increases could be tempered by abolishing mortgage interest relief, but it is not the case that every euro you lose in deduction translates directly into bidding one euro less on a house.

“It is rather perverse to pretend that removing a tax benefit that actually helps first-time buyers is a way to help them. That is not to say we should not do it, because ultimately it would make the balance between buying and renting somewhat fairer.”

‘Especially people who own their homes outright, with substantial equity and little mortgage debt, benefit from a low imputed rental value’

What would be a better idea to solve the housing crisis than abolishing mortgage interest relief?

“Raising the imputed rental value – the tax on living in an owner-occupied home. But nobody talks about that. The tax base for the imputed rental value is only 0.35 percent of the property value. Landlords, by contrast, are taxed on their actual return, often more than 3 percent of the property value per year. The tax base is therefore more than ten times larger for landlords than for owners. That difference makes renting expensive and letting unattractive, while owning a home is heavily subsidised. There is hardly any attention for this in the public debate, and there are even parties, such as Volt, that want to abolish it.

“Especially people who own their homes outright, with substantial equity and little mortgage debt, benefit from a low imputed rental value. These are typically older people. If their house rises in value, and the imputed rental value is a significant percentage of that, they have to pay more tax while their income does not rise. But you could argue that someone who can no longer afford a large, expensive house could move to a smaller home so a family can move into the larger one. That might be fairer, but it is not what people want for themselves.

“I therefore find it cynical that the discussion is primarily about mortgage interest relief. Politics pretends to help first-time buyers, but in reality it lines the pockets of older homeowners by keeping the imputed rental value low.”

Read more

-

‘Wages should be going up by a lot, since they haven’t kept pace with profits’

Gepubliceerd op:-

The Issue

-

De redactie

Latest news

-

University calls on people to remind smokers, security guards don’t send smokers off campus

Gepubliceerd op:-

Campus

-

-

What do the new European housing plans mean for students?

Gepubliceerd op:-

Campus

-

-

Makeover for Erasmus Magazine: new and more accessible website is live

Gepubliceerd op:-

Campus

-

Comments

Comments are closed.

Read more in the issue

-

A self-funded war: how Sudan got trapped in a fatal deadlock

Gepubliceerd op:-

The Issue

-

-

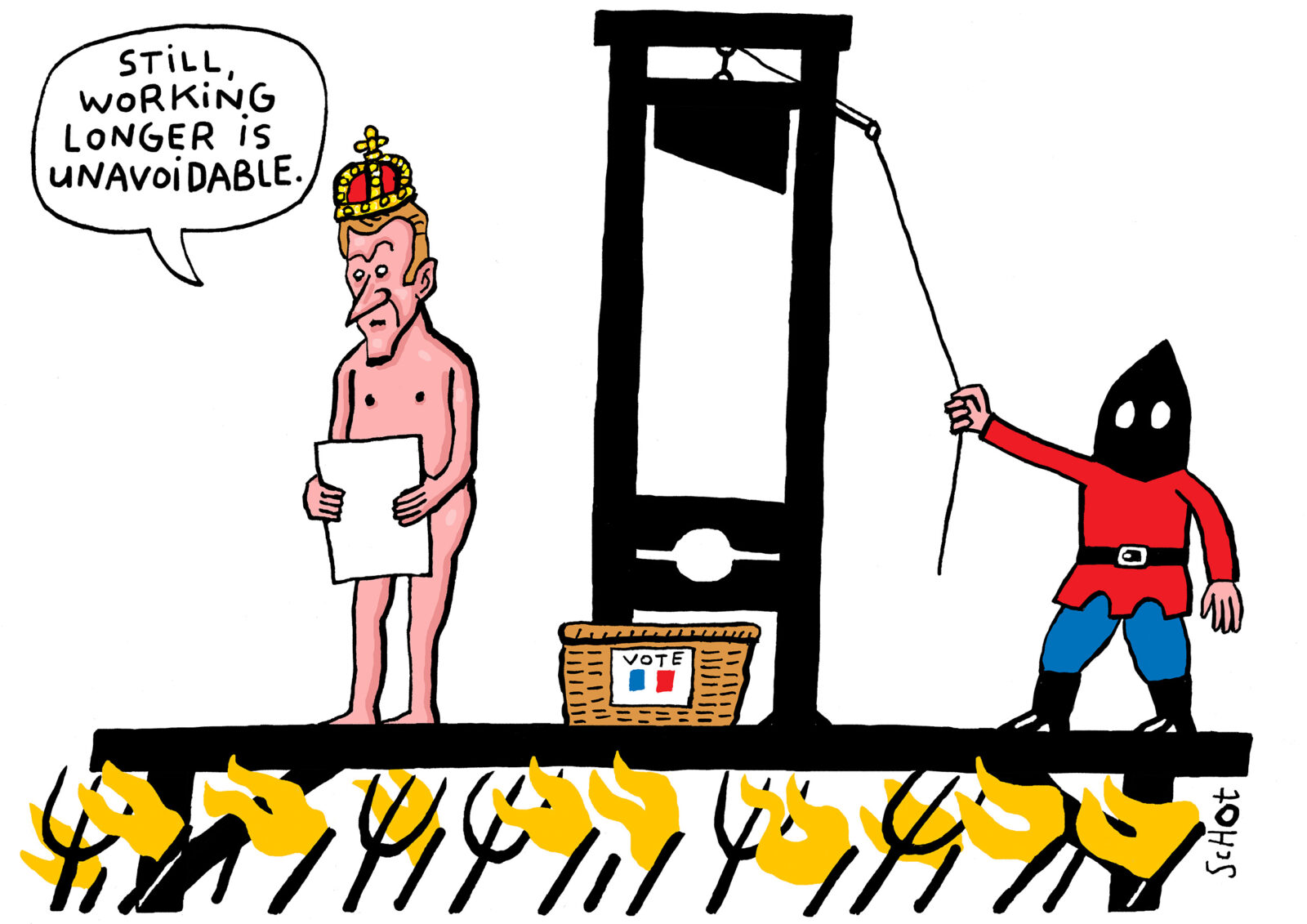

Why French politics is faltering under pension pressure

Gepubliceerd op:-

The Issue

-

-

‘Artists like Bob Vylan and Kneecap are more than just a mirror of society’

Gepubliceerd op:-

The Issue

-