Half of tax law professors hold commercial side jobs

Half of all professors of tax law also have a paid job in the private sector, according to a new count by Leiden University. Not all of them are transparent about this.

Image by: Jowan de Haan

At the end of February, the Senate received a ‘no’ from Eppo Bruins. The Minister of Education could not tell senators how many tax law professors have a commercial side job.

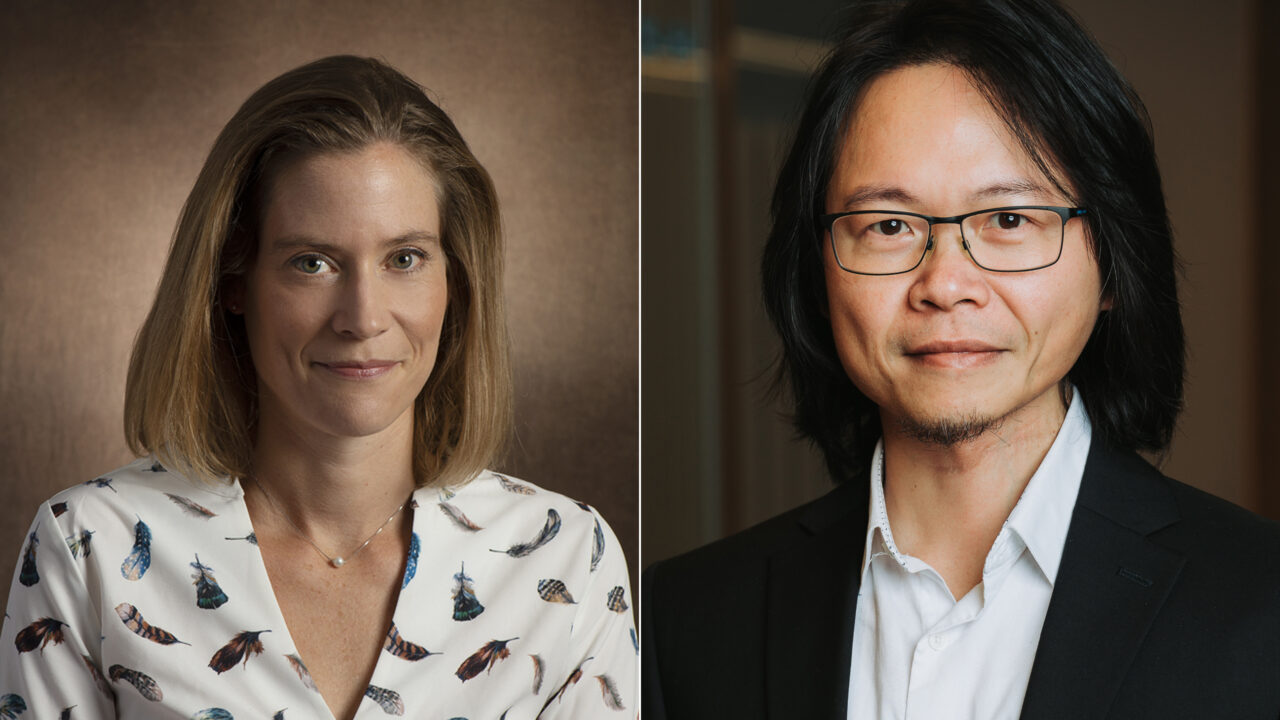

Leiden University can, as it now turns out. On Tuesday, professor of tax law Jan Vleggeert published a list of 68 professors of tax law and their additional positions. More than seventy percent wear two hats: twenty percent work in public administration or the judiciary, while fifty percent have a commercial side job.

This latter group includes 35 professors who advise companies or wealthy individuals. They do so for large consultancy firms such as EY (with four affiliated professors), PwC (five), and KPMG (two). Slightly smaller firms also value having a foothold in academia, including BDO, Mazars, BakerTilly and Loyens & Loeff. The latter pays three professors for advice and employs another two directly.

A good thing

At Erasmus University, all tax law professors hold additional roles, though most are judges or members of the Council of State. Four of the nine have commercial side jobs.

The University of Amsterdam has the highest relative number of commercial dual roles: eight out of nine. The Vrije Universiteit is also high, with five out of six professors in this category.

Not everyone sees this as a problem. In response to questions from the Hoger Onderwijs Persbureau, the University of Amsterdam described side jobs as “essentially a good thing: they create strong links with society, enrich education and contribute to the impact of research”. It’s also difficult to attract full-time tax law professors, the university added. Sector salaries are “significantly higher” than those at the university.

Gaps

Not all professors are transparent about their side jobs, even when those are closely related to their academic work. Vleggeert and his student assistant found “gaps” for eight of the 68 professors on the list. They found various additional roles through public sources that were not mentioned on university websites.

Some professors offered explanations. One, for instance, said he had already retired from PwC and as a professor. But at the time Vleggeert compiled the list, this was not reflected on either his LinkedIn profile or the university website.

In some cases, the roles were listed in a separate register but not on the professor’s personal university page. Vleggeert: “It seems to me that maximum transparency would be best.”

Incomplete

Until recently, Nyenrode Business Universiteit took a different view. Anyone wanting to know about a professor’s side jobs had to consult the central register. According to the private university, it is ‘central, transparent and accessible’ and is ‘updated annually’.

But even Nyenrode’s central register is incomplete. For example, tax law professor Rudolf de Vries failed to list his work for consultancy firm EY. Nyenrode has now said it will correct this ‘in the next update’. De Vries has not responded to questions from HOP. However, his LinkedIn profile was updated last Monday.

Nyenrode has now confirmed it will also start listing side jobs on professors’ personal pages, as other universities already do. That avoids the need to hunt for the register – but only if the website and the register show the same information.

“It’s true that I was involved in tax avoidance structures, but when I turned 50 I started to wonder what I had been doing”

For instance, Hans van den Hurk, a Maastricht-based tax specialist, lists no commercial roles under ‘additional positions’ on his UM profile, even though public sources indicate he has at least two. His profile merely states, in general terms, that he advises multinationals on their tax strategies.

Van den Hurk says ‘not every role is visible due to technical issues’. He claims to have reported his additional positions, and says, “They have been approved by Maastricht University.” The technical problem will be resolved as soon as possible.

Pot calling the kettle black

Van den Hurk seems annoyed at being called out for his side jobs. He stressed in an email that he has ‘never sold tax avoidance structures’. On the contrary, he helps South American countries to combat them. He claims the same cannot be said for Jan Vleggeert, the compiler of the list, who in the past helped companies and wealthy individuals avoid tax.

Vleggeert confirms he worked as a tax advisor. “It’s true that I was involved in tax avoidance structures. But when I turned 50 I started to wonder what I had been doing. This isn’t right, I thought. That’s why I made the deliberate choice to move into academia – to promote fair taxation by multinationals and the wealthy.”

In his research, Vleggeert names professors, but insists he is not questioning their integrity. In 2020, during his inaugural lecture, he criticised the influence of consultancy firms on academia. This drew a lot of criticism from people who felt personally attacked, he recalls. “But my concern is with the discipline as a whole.”

Independence

He decided to count dual roles after reading that the minister had told the Senate he couldn’t provide figures on this. “But it turns out not to be that difficult”, says Vleggeert now.

He is concerned about the independence of his field. A professor who one moment helps a client reduce their tax bill must the next moment be critical of such strategies as an independent academic. “If so many professors with dual roles must consider their employer’s interests, then tax law as a discipline in the Netherlands is not independent enough.”

That’s also the fear of Daan Roovers, senator for GroenLinks–PvdA. “I’m concerned about the system as a whole, even if all individual professors behave with integrity”, she told HOP in November.

Roovers hopes the ministry will use the Leiden research to set a benchmark: “At what percentage of professors linked to commercial advisory firms can academic independence still be guaranteed? What do the ministry and universities think about that? I urge the minister to take this on.”

‘In the Netherlands, tax consultancies, academia and political committees are so intertwined that at the very least there is a strong appearance of a conflict of interest’

Too easy

Concerns about professors’ side jobs have existed for some time. In 2016, Oxfam Novib mapped the ties between consultancies and universities. “In the Netherlands, tax consultancies, academia and political committees are so intertwined that at the very least there is a strong appearance of a conflict of interest”, it wrote. This made the Dutch tax climate especially favourable for multinationals.

But Bastiaan Starink, professor in Tilburg and partner at PwC, sees no issue with holding dual roles. It depends on how you handle them, he argues. “What I don’t like about this debate is the suggestion that a dual role automatically makes you untrustworthy. That’s far too simplistic and just isn’t true.”

He’s less concerned about the system as a whole. “What matters to me is that individual researchers behave with integrity. That’s why we have a code of conduct and must be transparent to an almost absurd degree, about funding and interests. Precisely to safeguard that integrity.”

To make it clear that he wears two hats, Starink’s Tilburg University profile states that he is also a tax lawyer at PwC Belastingadviseurs. The same is listed in the university’s register of side jobs.

Unpaid work

A side job in public administration can also create a conflict of interest, and the same standards of transparency should apply. Arjen Schep, an endowed professor specialising in local government taxation, does not state on his website or in the register that he also works for the international arm of the Association of Dutch Municipalities (VNG). His department even referred to him as ‘scientist in residence’ in an annual report.

Schep agrees that things could be more transparent but points out that he is not personally paid for this work. He helps developing countries reform their local tax systems on behalf of VNG International, and the money goes to his faculty, which uses it to fund his chair. The large municipalities don’t pay enough to cover the cost of his position, so Schep also conducts contract research. “It’s my own independent academic decision to work with VNG International.”

Sanctions

Senators are concerned that side jobs are not properly disclosed. Paul van Meenen (D66) advocates sanctions. “The minister must be able to act as the responsible authority for the system.” The academic code of integrity asks researchers to be transparent about “potential conflicts of interest”, but “without sanctions, too many people ignore such codes”, the senator argues.

The VVD also wants more clarity but feels sanctions go too far, says senator Paulien Geerdink. She still hopes universities will see the light themselves and ensure that all professors report their side jobs as soon as possible.

In recent years, views on registering side jobs have slowly shifted. In 2008, there were still concerns about professors’ privacy. Today, all universities have a register.

But what if a professor doesn’t report their side job? University responses suggest they don’t see it as a major issue. Maastricht University didn’t seem particularly bothered either, two weeks ago, when it admitted it had failed to supervise a professor of epidemiology who also worked for the chemical industry. The university said he would have to update the register – though that still hasn’t happened.

Lees meer

-

Senators demand ‘facts’ on fiscal law and business

Gepubliceerd op:-

Politics

-

Ordinary people

There’s now a separate debate about the side jobs of tax law professors – partly prompted by the childcare benefits scandal. NSC leader Pieter Omtzigt has often asked how it is that tax law scholars didn’t flag the issue. Is it because of their dual roles? Are they too focused on corporate taxation and too little on “ordinary” people?

A few years ago, another concern emerged. MPs were found to be forwarding questions from tax advisors about tax legislation almost verbatim to the government, forcing ministers to respond to lobbying questions from the Dutch Association of Tax Advisers. Critics argued they seemed to be fishing for legal loopholes.

Tax legislation is often complex, and professors are regularly asked to advise the government. The fact that many also have a commercial practice casts doubt on these recommendations. Whose interests are they really serving?

Former state secretary for taxation Hans Vijlbrief eventually decided to stop inviting anyone with a dual role to advisory committees. But, he added, this is difficult given the high percentage of professors with such roles.

Improvement

Universities appear to be getting the message too. Erasmus University is working to make its tax law department more independent from external funders. Endowed professors (often funded by companies or foundations) are becoming full professors, says Arjen Schep, who also chairs the department. “That reduces the risk of outside influence.” The University of Amsterdam is also actively looking to appoint more full-time professors, a spokesperson says.

According to Jan Vleggeert, there has been some improvement since 2021. Back then, 65 percent of tax law professors had a commercial side job – compared to 51 percent now. This drop is partly due to some professors retiring as partners in recent years, though continuing in academia.

This year, a number of professors without commercial roles are due to retire. If universities take no action, the proportion of professors with dual roles may rise again, Vleggeert warns. He is therefore calling for a “dual-role freeze” when appointing new professors.

De redactie

Latest news

-

Letschert gives nothing away in first parliamentary debate

Gepubliceerd op:-

Education

-

Politics

-

-

Away with the ‘profkip’, says The Young Academy

Gepubliceerd op:-

Science

-

-

House of Representatives wants basic grant for university master after HBO

Gepubliceerd op:-

Money

-

Politics

-

Comments

Comments are closed.

Read more in Science

-

Away with the ‘profkip’, says The Young Academy

Gepubliceerd op:-

Science

-

-

Two Vici grants for researchers ESE and ESPhil

Gepubliceerd op:-

Science

-

-

Participants in dialogue on academic freedom want actions to match words

Gepubliceerd op:-

Science

-